February 2024 CPI Report

Understanding the February 2024 CPI Report: Key Insights and Analysis

The February 2024 CPI Report has sparked significant interest and discussion among economists, policymakers, and consumers alike. In this comprehensive analysis, we delve deep into the nuances of the report, providing valuable insights and shedding light on critical trends shaping the economy.

Overview of the CPI Report

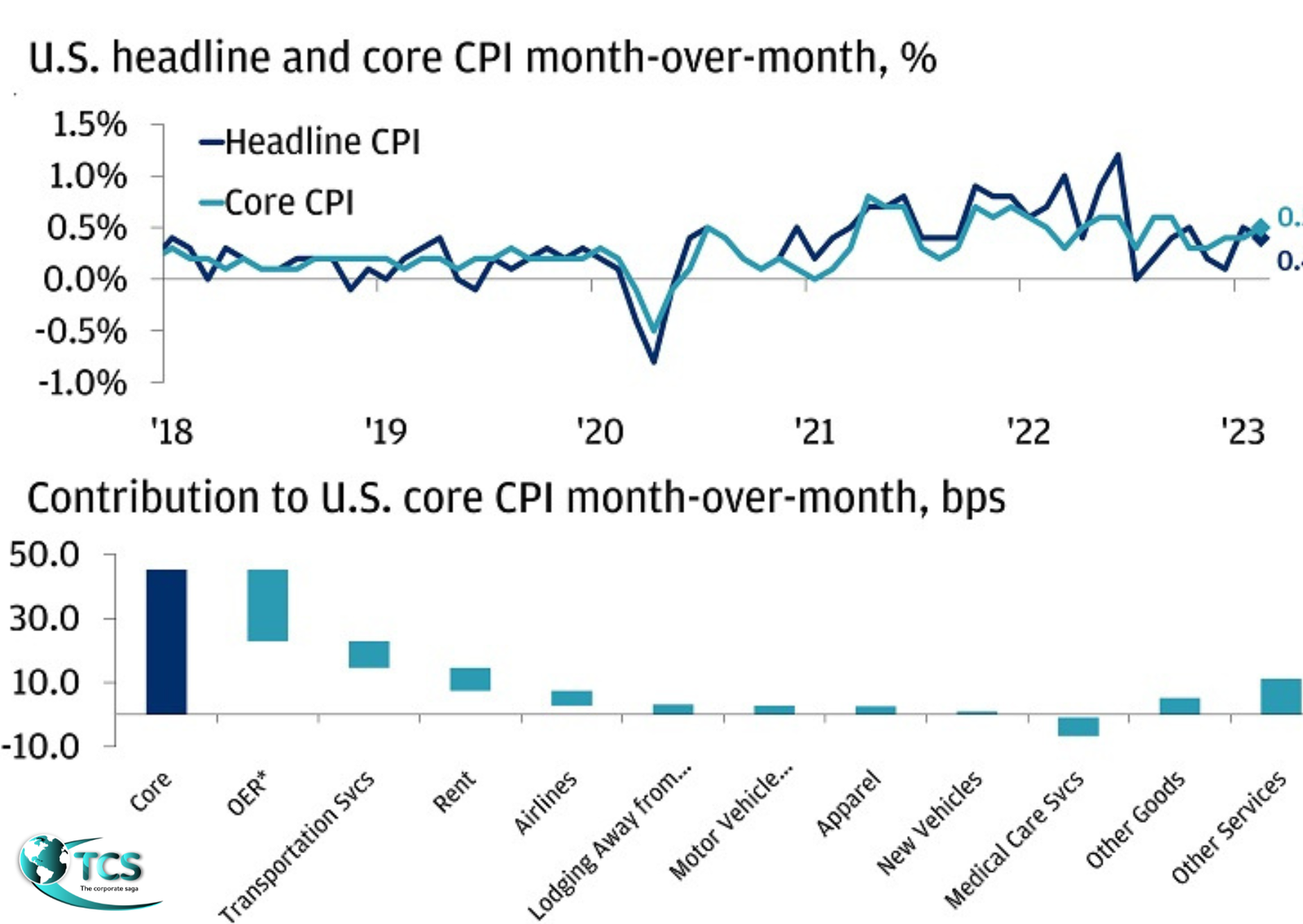

The latest Consumer Price Index (CPI) data reveals that inflation remained steady in February, with a modest increase of 0.4 percent compared to the previous month. Over the past year, inflation has stood at 3.2 percent, highlighting the persistent upward pressure on prices. Core inflation, which excludes volatile food and energy prices to gauge the underlying trend, mirrored the overall inflation rate, registering 0.4 percent for the month and 3.8 percent annually.

Analyzing Categories Driving Inflation

1. Core Goods

The CPI report highlights a noteworthy trend in core goods inflation, which has seen a significant easing as post-pandemic supply chains stabilize. While core goods prices experienced a slight uptick of 0.1 percent in February, the six-month data paints a more revealing picture, showing a 1.5 percent decline in prices. This reversal underscores the impact of supply chain disruptions during the pandemic, followed by a gradual normalization as demand waned and supply chains adapted.

2. Housing

Housing remains a dominant factor in the CPI, comprising over a third of the total index and approximately 45 percent of the core index. Despite a peak in housing inflation at nearly 9 percent in January of the previous year, recent data indicates a moderation in housing costs, with a 0.4 percent increase recorded in February. While this marks a decline from previous levels, housing inflation remains elevated relative to pre-pandemic averages, reflecting the enduring challenges in the U.S. housing market.

3. Non-Housing Services (NHS)

The category of non-housing services, excluding housing-related expenses, encompasses a diverse range of sectors and represents a substantial portion of the core inflation market basket. Recent data indicates a 0.5 percent increase in NHS inflation for February, down from 0.8 percent in January. However, a closer examination reveals a nuanced picture, with certain sectors experiencing upward pressure on prices, particularly in less wage-sensitive areas such as medical care services and airfares.

Impact of Policy Measures

President Biden’s FY 2025 budget, unveiled recently, outlines ambitious initiatives aimed at addressing housing affordability and expanding the supply of affordable housing. These policy measures signal a concerted effort to tackle the long-standing challenges in the housing market and alleviate the burden on renters and homeowners.

Key Takeaways

The February 2024 CPI Report offers valuable insights into the dynamics of inflation and its underlying drivers. From the stabilization of core goods prices to the persistent challenges in the housing market, each category provides critical information for policymakers and economists alike. As policymakers continue to navigate these economic trends, it is imperative to remain vigilant and proactive in addressing the factors contributing to inflationary pressures.

In conclusion, the CPI report serves as a vital tool for understanding the evolving economic landscape and guiding informed decision-making. By dissecting the various components of inflation and analyzing their implications, we can better grasp the complexities of the economy and chart a course towards sustainable growth and stability.